Investors

$46.95

Price

As of December 5, 2025

$0.98

Price Change

Change from December 4, 2025

$80.79

NAV Per Share

As of December 5, 2025

$-0.54

NAV Change

Change from December 4, 2025

2.3%

YIELD

As of December 5, 2025

Compound Annual Total Rates of Return

As of November 30, 2025

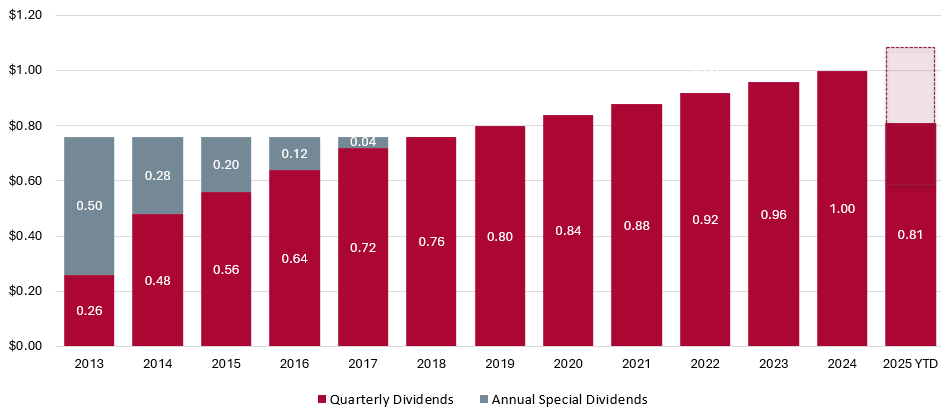

Over $466M cumulative payouts since 1998

Steady, consistent & growing quarterly dividends

Suitable for investors with long time horizons and a need for tax efficient income

Top 10 Holdings

As of November 28, 2025

| Issuer | Market Value | % of Portfolio |

|---|---|---|

| Celestica Inc. | 156,516 | 8.3 |

| NVIDIA Corporation | 93,992 | 5.0 |

| Franco-Nevada Corporation | 84,724 | 4.5 |

| Shopify Inc. | 70,091 | 3.7 |

| Dollarama Inc. | 61,985 | 3.3 |

| Canadian Pacific Kansas City Limited | 58,207 | 3.1 |

| WSP Global Inc. | 57,446 | 3.0 |

| First Quantum Minerals Ltd. | 57,312 | 3.0 |

| Cameco Corporation | 55,778 | 2.9 |

| Mastercard Incorporated | 55,392 | 2.9 |

| Total of Ten Largest Investments | 751,443 | 39.7 |

| Total Investment Portfolio | 1,893,214 | 100.0 |

The investment portfolio may change due to ongoing portfolio transactions of the investment fund.

Sector Allocation

As of November 30, 2025

The investment portfolio may change due to ongoing portfolio transactions of the investment fund.

Latest News

Subscribe for Updates

Sign up for press release email alerts and updates on CGI.

Notes

The chart above shows the past performance of CGI. Past performance does not necessarily indicate how CGI will perform in the future. The rate of return is used only to illustrate the effects of the compound growth rate and is not intended to reflect future values of CGI or returns on investment in CGI.

Returns for CGI are unaudited.

This webpage is for information purposes only and does not constitute an offer to sell or a solicitation to buy the securities referred to herein. The opinions contained in this report are solely those of Morgan Meighan & Associates (“MMA”) and are subject to change without notice. MMA makes every effort to ensure that the information has been derived from sources believed to be reliable and accurate. However, MMA assumes no responsibility for any losses or damages, whether direct or indirect which arise from the use of this information. MMA is under no obligation to update the information contained herein. The information should not be regarded as a substitute for the exercise of your own judgment. Please read the annual information form before investing.

You will usually pay brokerage fees to your dealer if you purchase or sell shares of the investment fund on the Toronto Stock Exchange or London Stock Exchange system (each an “exchange”). If the shares are purchased or sold on an exchange, investors may pay more than the current net asset value when buying shares of the investment fund and may receive less than the current net asset value when selling them.

There are ongoing fees and expenses associated with owning shares of an investment fund. The indicated rates of return are the historical annual compounded total returns including changes in share value and reinvestment of all distributions and do not take into account certain fees such as brokerage commissions or income taxes payable by any securityholder that would have reduced returns. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

Information contained on this webpage was published at a specific point in time. Upon publication, it is believed to be accurate and reliable, however, we cannot guarantee that it is complete or current at all times. Certain statements contained on this webpage constitute forward-looking information within the meaning of Canadian securities laws. Forward-looking information may relate to matters disclosed on this webpage and to other matters identified in public filings relating to the fund, to the future outlook of the fund and anticipated events or results and may include statements regarding the future financial performance of the fund. In some cases, forward-looking information can be identified by terms such as “may”, “will”, “should”, “expect”, “plan”, “anticipate”, “believe”, “intend”, “estimate”, “predict”, “potential”, “continue” or other similar expressions concerning matters that are not historical facts. Actual results may vary from such forward-looking information. Investors should not place undue reliance on forward-looking statements. These forward-looking statements are made as of the date hereof and we assume no obligation to update or revise them to reflect new events or circumstances.