Dividends

CGI pays two types of dividends to common shareholders: regular dividends and capital gains dividends. CGI designates all regular dividends as “eligible dividends” for purposes of the Income Tax Act (Canada).

Qualifying as an investment corporation for tax purposes, payment of capital gains dividends allows CGI to recover taxes paid, or payable, on realized capital gains. The type of dividend paid is indicated at the time of the announcement.

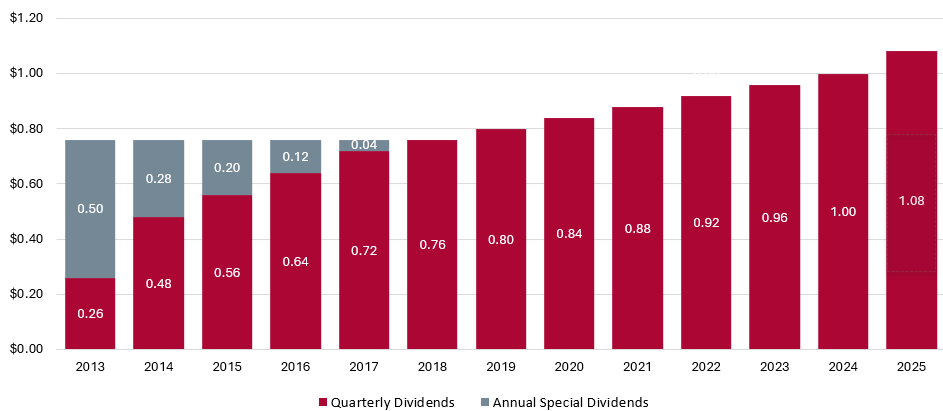

CGI is committed to providing its common shareholders with steady to rising quarterly dividends over time. This distribution policy is intended to provide greater certainty to its shareholders regarding distributions while also providing growth potential and enhanced dividend returns over time. CGI’s quarterly dividends have risen steadily since 2013.

Over $466M cumulative payouts since 1998

Steady, consistent & growing quarterly dividends

Suitable for investors with long time horizons and a need for tax efficient income

| Ex-Date | Record Date | Payable Date | Amount | Type |

|---|---|---|---|---|

| 2025 | ||||

| 2025-11-2811-28 | 2025-11-2811-28 | 2025-12-1512-15 | 0.270 | Capital Gains |

| 2025-08-2908-29 | 2025-08-2908-29 | 2025-09-1509-15 | 0.270 | Capital Gains |

| 2025-05-3005-30 | 2025-05-3005-30 | 2025-06-1506-15 | 0.270 | Regular |

| 2025-02-2802-28 | 2025-02-2802-28 | 2025-03-1503-15 | 0.270 | Regular |

| 2024 | ||||

| 2024-11-2911-29 | 2024-11-2911-29 | 2024-12-1512-15 | 0.250 | Regular |

| 2024-08-3008-30 | 2024-08-3008-30 | 2024-09-1509-15 | 0.250 | Regular |

| 2024-05-3105-31 | 2024-05-3105-31 | 2024-06-1506-15 | 0.250 | Regular |

| 2024-02-2802-28 | 2024-02-2902-29 | 2024-03-1503-15 | 0.250 | Regular |

| 2023 | ||||

| 2023-11-2911-29 | 2023-11-3011-30 | 2023-12-1512-15 | 0.240 | Capital Gains |

| 2023-08-3008-30 | 2023-08-3108-31 | 2023-09-1509-15 | 0.240 | Regular |

| 2023-05-3005-30 | 2023-05-3105-31 | 2023-06-1506-15 | 0.240 | Regular |

| 2023-02-2702-27 | 2023-02-2802-28 | 2023-03-1503-15 | 0.240 | Regular |

| 2022 | ||||

| 2022-11-2911-29 | 2022-11-3011-30 | 2022-12-1512-15 | 0.230 | Regular |

| 2022-08-3008-30 | 2022-08-3108-31 | 2022-09-1509-15 | 0.230 | Regular |

| 2022-05-3005-30 | 2022-05-3105-31 | 2022-06-1506-15 | 0.230 | Regular |

| 2022-02-2502-25 | 2022-02-2802-28 | 2022-03-1503-15 | 0.230 | Regular |

| 2021 | ||||

| 2021-11-2911-29 | 2021-11-3011-30 | 2021-12-1512-15 | 0.220 | Capital Gains |

| 2021-08-3008-30 | 2021-08-3108-31 | 2021-09-1509-15 | 0.220 | Capital Gains |

| 2021-05-2805-28 | 2021-05-3105-31 | 2021-06-1506-15 | 0.220 | Regular |

| 2021-02-2502-25 | 2021-02-2602-26 | 2021-03-1503-15 | 0.220 | Regular |

| 2020 | ||||

| 2020-11-2711-27 | 2020-11-3011-30 | 2020-12-1512-15 | 0.210 | Capital Gains |

| 2020-08-2808-28 | 2020-08-3108-31 | 2020-09-1509-15 | 0.210 | Regular |

| 2020-05-2805-28 | 2020-05-2905-29 | 2020-06-1506-15 | 0.210 | Regular |

| 2020-02-2702-27 | 2020-02-2802-28 | 2020-03-1503-15 | 0.210 | Regular |

| 2019 | ||||

| 2019-11-2811-28 | 2019-11-2911-29 | 2019-12-1512-15 | 0.200 | Capital Gains |

| 2019-08-2908-29 | 2019-08-3008-30 | 2019-09-1509-15 | 0.200 | Capital Gains |

| 2019-05-3005-30 | 2019-05-3105-31 | 2019-06-1506-15 | 0.200 | Regular |

| 2019-02-2702-27 | 2019-02-2802-28 | 2019-03-1503-15 | 0.200 | Regular |

| 2018 | ||||

| 2018-11-2911-29 | 2018-11-3011-30 | 2018-12-1512-15 | 0.190 | Capital Gains |

| 2018-08-3008-30 | 2018-08-3108-31 | 2018-09-1509-15 | 0.190 | Regular |

| 2018-05-3005-30 | 2018-05-3105-31 | 2018-06-1506-15 | 0.190 | Regular |

| 2018-02-2702-27 | 2018-02-2802-28 | 2018-03-1503-15 | 0.190 | Regular |

| 2017 | ||||

| 2017-12-2012-20 | 2017-12-2112-21 | 2017-12-2712-27 | 0.040 | Capital Gains |

| 2017-11-2911-29 | 2017-11-3011-30 | 2017-12-1512-15 | 0.180 | Capital Gains |

| 2017-08-2908-29 | 2017-08-3108-31 | 2017-09-1509-15 | 0.180 | Capital Gains |

| 2017-05-2905-29 | 2017-05-3105-31 | 2017-06-1506-15 | 0.180 | Regular |

| 2017-02-2402-24 | 2017-02-2802-28 | 2017-03-1503-15 | 0.180 | Regular |

| 2016 | ||||

| 2016-12-2012-20 | 2016-12-2212-22 | 2016-12-2812-28 | 0.120 | Capital Gains |

| 2016-11-2811-28 | 2016-11-3011-30 | 2016-12-1512-15 | 0.160 | Capital Gains |

| 2016-08-2908-29 | 2016-08-3108-31 | 2016-09-1509-15 | 0.160 | Regular |

| 2016-05-2705-27 | 2016-05-3105-31 | 2016-06-1506-15 | 0.160 | Regular |

| 2016-02-2502-25 | 2016-02-2902-29 | 2016-03-1503-15 | 0.160 | Regular |

| 2015 | ||||

| 2015-12-2112-21 | 2015-12-2312-23 | 2015-12-2912-29 | 0.200 | Capital Gains |

| 2015-11-2611-26 | 2015-11-3011-30 | 2015-12-1512-15 | 0.140 | Capital Gains |

| 2015-08-2708-27 | 2015-08-3108-31 | 2015-09-1509-15 | 0.140 | Capital Gains |

| 2015-05-2705-27 | 2015-05-2905-29 | 2015-06-1506-15 | 0.140 | Regular |

| 2015-02-2502-25 | 2015-02-2702-27 | 2015-03-1503-15 | 0.140 | Regular |

| 2014 | ||||

| 2014-12-1912-19 | 2014-12-2312-23 | 2014-12-2912-29 | 0.280 | Capital Gains |

| 2014-11-2611-26 | 2014-11-2811-28 | 2014-12-1512-15 | 0.120 | Capital Gains |

| 2014-08-2708-27 | 2014-08-2708-27 | 2014-09-1509-15 | 0.120 | Capital Gains |

| 2014-05-2805-28 | 2014-05-3005-30 | 2014-06-1506-15 | 0.120 | Regular |

| 2014-02-2602-26 | 2014-02-2802-28 | 2014-03-1503-15 | 0.120 | Regular |

| 2013 | ||||

| 2013-12-1912-19 | 2013-12-2312-23 | 2013-12-2712-27 | 0.500 | Capital Gains |

| 2013-11-2711-27 | 2013-11-2911-29 | 2013-12-1512-15 | 0.080 | Regular |

| 2013-08-2808-28 | 2013-08-3008-30 | 2013-09-1509-15 | 0.060 | Regular |

| 2013-05-2905-29 | 2013-05-3105-31 | 2013-06-1506-15 | 0.060 | Regular |

| 2013-02-2602-26 | 2013-02-2802-28 | 2013-03-1503-15 | 0.060 | Regular |

| 2012 | ||||

| 2012-12-1012-10 | 2012-12-1212-12 | 2012-12-1512-15 | 0.060 | Regular |

| 2012-09-1009-10 | 2012-09-1209-12 | 2012-09-1509-15 | 0.060 | Regular |

| 2012-06-0806-08 | 2012-06-1206-12 | 2012-06-1506-15 | 0.060 | Regular |

| 2012-03-0803-08 | 2012-03-1203-12 | 2012-03-1503-15 | 0.060 | Regular |

| 2012-12-2012-20 | 2012-12-2412-24 | 2012-12-2812-28 | 0.520 | Capital Gains |

| 2011 | ||||

| 2011-12-2012-20 | 2011-12-2212-22 | 2011-12-2812-28 | 0.560 | Capital Gains |

| 2011-12-0812-08 | 2011-12-1212-12 | 2011-12-1512-15 | 0.060 | Regular |

| 2011-09-0809-08 | 2011-09-1209-12 | 2011-09-1509-15 | 0.060 | Regular |

| 2011-06-0806-08 | 2011-06-1006-10 | 2011-06-1506-15 | 0.060 | Regular |

| 2011-03-0803-08 | 2011-03-1003-10 | 2011-03-1503-15 | 0.060 | Regular |

| 2010 | ||||

| 2010-12-2012-20 | 2010-12-2212-22 | 2010-12-2412-24 | 0.760 | Capital Gains |

| 2010-12-0812-08 | 2010-12-1012-10 | 2010-12-1512-15 | 0.060 | Regular |

| 2010-09-0809-08 | 2010-09-1009-10 | 2010-09-1509-15 | 0.060 | Regular |

| 2010-06-0806-08 | 2010-06-1006-10 | 2010-06-1506-15 | 0.060 | Regular |

| 2010-03-0803-08 | 2010-03-1003-10 | 2010-03-1503-15 | 0.060 | Regular |

| 2009 | ||||

| 2009-12-2212-22 | 2009-12-2412-24 | 2009-12-3012-30 | 0.500 | Capital Gains |

| 2009-12-0812-08 | 2009-12-1012-10 | 2009-12-1512-15 | 0.060 | Regular |

| 2009-09-0809-08 | 2009-09-1009-10 | 2009-09-1509-15 | 0.060 | Regular |

| 2009-06-0806-08 | 2009-06-1006-10 | 2009-06-1506-15 | 0.060 | Regular |

| 2009-03-0903-09 | 2009-03-1103-11 | 2009-03-1503-15 | 0.060 | Regular |

| 2008 | ||||

| 2008-11-2611-26 | 2008-11-2811-28 | 2008-12-1512-15 | 0.060 | Regular |

| 2008-08-2708-27 | 2008-08-2908-29 | 2008-09-1509-15 | 0.060 | Regular |

| 2008-05-2805-28 | 2008-05-3005-30 | 2008-06-1506-15 | 0.060 | Regular |

| 2008-02-2702-27 | 2008-02-2902-29 | 2008-03-1503-15 | 0.060 | Regular |